Price and Analyze Financial Instruments

This toolbox provides tools to analyze basic fixed-income and derivative instruments. Fixed-income instruments use Securities Industry Association or SIA-compatible analytics for pricing, yield curve modeling, and sensitivity analysis for government, corporate, and municipal fixed-income securities. Derivative instruments use basic Black-Scholes, Black, and binomial option-pricing to compute a standard market model of equity pricing and to calculate the sensitivities of option greeks, such as lambda, theta, and delta. Financial Instruments Toolbox™ supports additional functionality for pricing fixed-income and equity derivative instruments. For more information, see Price Interest-Rate Instruments (Financial Instruments Toolbox) and Price Equity, FX, Commodity, or Energy Instruments (Financial Instruments Toolbox).

Categories

- Analyze Yield Curves

Analyze interest-rate yield curve to determine zero, discount, forward, and par curves

- Price Fixed-Income Instruments

Analyze term structure, interest rates, accrued interest, bond prices, treasury bills, sensitivities, and yields

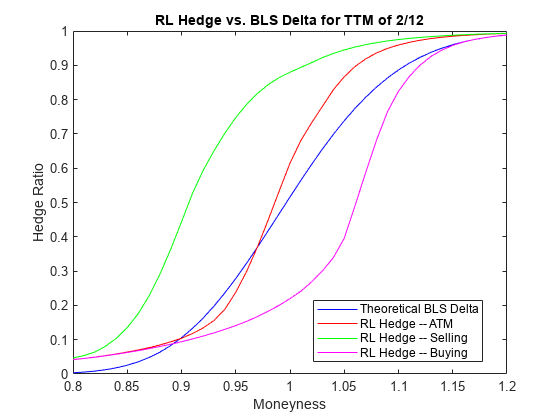

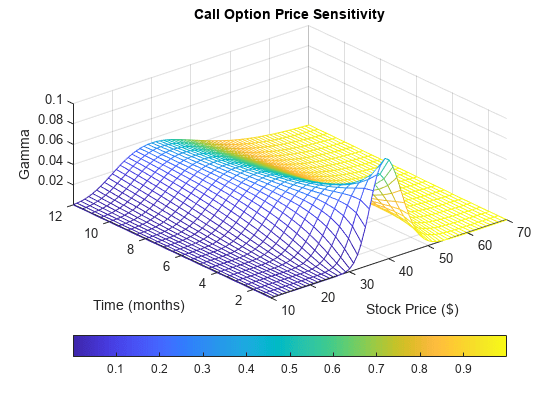

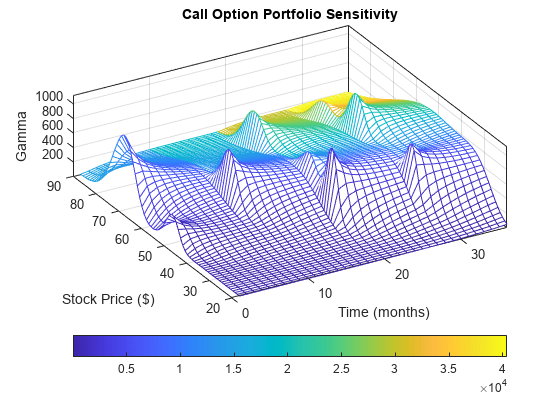

- Price Derivative Instruments

Analyze equity option valuation and sensitivity