Computational Finance

Import and analyze financial data, develop models for risk and economic systems,

manage investments, and price complex instruments

MATLAB® products for computational finance enable you to develop quantitative applications for investment and risk management, econometrics, pricing and valuation, insurance, and algorithmic trading. By writing only a few lines of code, you can:

Chart historical and live market data.

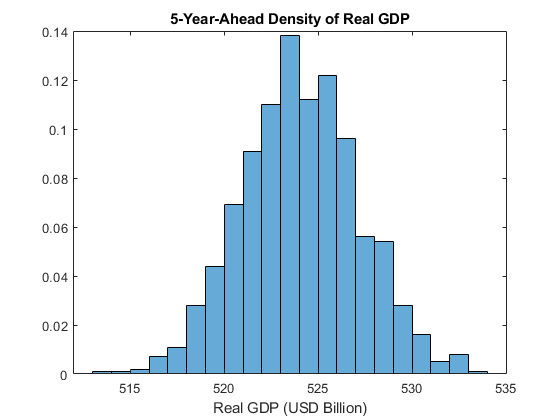

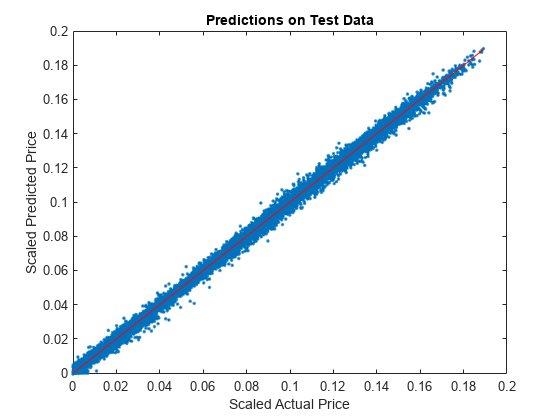

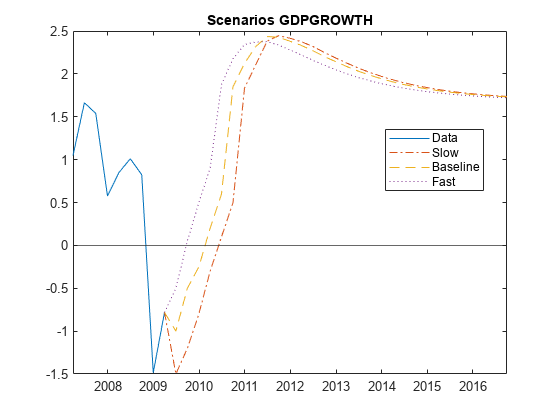

Analyze time series data and create predictive models.

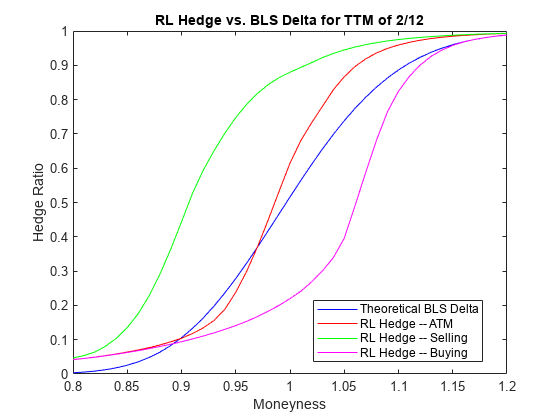

Model interest rates and perform sensitivity analyses.

Optimize a portfolio and perform risk attribution.

Develop quantitative models to optimize performance and minimize risk.

Products for Computational Finance

Topics

Access Databases and Financial Data Exchanges

- Connect to Database (Database Toolbox)

After configuring a driver and data source, connect to your database. - Communicating with Data Service Providers (Datafeed Toolbox)

Find the connection function for each supported data service provider.

Analyze and Model Financial and Economic Time Series

- Analyze Time Series Data Using Econometric Modeler (Econometrics Toolbox)

Interactively visualize and analyze univariate or multivariate time series data. - Represent Time Series Models Using Econometrics Toolbox Objects (Econometrics Toolbox)

Learn how to represent time series models as model objects.

Optimize and Backtest Portfolios

- Portfolio Optimization Examples Using Financial Toolbox (Financial Toolbox)

Follow a sequence of examples that highlight features of thePortfolio(Financial Toolbox) object. - Backtest Investment Strategies Using Financial Toolbox (Financial Toolbox)

Perform backtesting of portfolio strategies using a backtesting framework. - Diversify ESG Portfolios (Financial Toolbox)

This example shows how to include qualitative factors for environmental, social, and corporate governance (ESG) in the portfolio selection process. - Create Hierarchical Risk Parity Portfolio (Financial Toolbox)

This example shows how to compute a hierarchical risk parity (HRP) portfolio.

Price Complex Financial Instruments

- Price American Basket Options Using Standard Monte Carlo and Quasi-Monte Carlo Simulation (Financial Toolbox)

Model the fat-tailed behavior of asset returns and assess the impact of alternative joint distributions on basket option prices. - Calibrate Shifted SABR Model Parameters for Swaption Instrument (Financial Instruments Toolbox)

Calibrate model parameters for aSwaption(Financial Instruments Toolbox) instrument when you use aSABRpricing method.

Quantify Risk and Validate Risk Models

- Risk Modeling with Risk Management Toolbox (Risk Management Toolbox)

Learn about the tools for modeling seven areas of risk assessment. - Bin Data to Create Credit Scorecards Using Binning Explorer (Risk Management Toolbox)

Create a credit scorecard using the Binning Explorer app. - Credit Scoring Using Logistic Regression and Decision Trees (Risk Management Toolbox)

Create and compare two credit scoring models, one based on logistic regression and the other based on decision trees.

Deploy Applications to Production

- Deploy Relational Database Application with MATLAB Compiler (Database Toolbox)

Write a MATLAB script that connects to a relational database and deploy the script as a standalone database application to other machines.