portopt

Portfolios on constrained efficient frontier

portopt has been partially removed and will no longer accept

ConSet or varargin arguments. Use Portfolio instead to solve portfolio problems that are more than a

long-only fully-invested portfolio. For information on the workflow when using

Portfolio objects, see Portfolio Object Workflow. For more information on migrating

portopt code to Portfolio, see portopt Migration to Portfolio Object.

Syntax

Description

[

sets up the most basic portfolio problem with weights greater than or equal to

PortRisk,PortReturn,PortWts] = portopt(ExpReturn,ExpCovariance)0 that must sum to 1. All that is

necessary to solve this problem is the mean and covariance of asset returns. By

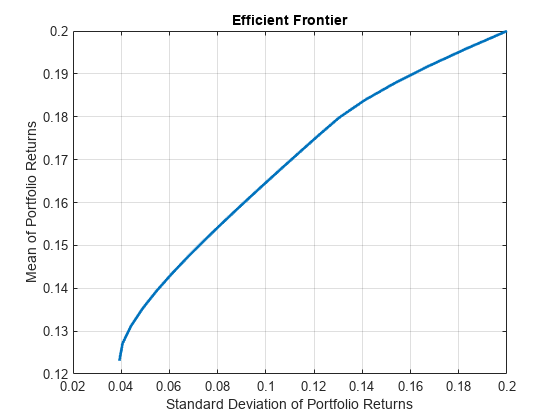

default, portopt returns 10 equally-spaced points on the

efficient frontier.

portopt solves the "standard" mean-variance portfolio

optimization problem for a long-only fully-invested investor with no additional

constraints. Specifically, every portfolios on the efficient frontier has

non-negative weights that sum to 1.

Note

An alternative for portfolio optimization is to use the Portfolio object for

mean-variance portfolio optimization. This object supports gross or net

portfolio returns as the return proxy, the variance of portfolio returns as

the risk proxy, and a portfolio set that is any combination of the specified

constraints to form a portfolio set. For information on the workflow when

using Portfolio objects, see Portfolio Object Workflow.

[

specifies options using one or more optional arguments in addition to the input

arguments in the previous syntax.PortRisk,PortReturn,PortWts] = portopt(___,NumPorts,PortReturn)

portopt(___,

returns a plot of the efficient frontier if NumPorts,PortReturn)portopt is invoked

with no output arguments.

Examples

Input Arguments

Output Arguments

Version History

Introduced before R2006a

See Also

ewstats | frontier | portstats | portcons | Portfolio

Topics

- Portfolio Construction Examples

- Plotting an Efficient Frontier Using portopt

- Portfolio Selection and Risk Aversion

- Bond Portfolio Optimization Using Portfolio Object

- Active Returns and Tracking Error Efficient Frontier

- portopt Migration to Portfolio Object

- Analyzing Portfolios

- Portfolio Optimization Functions