Machine Learning for Statistical Arbitrage: Introduction

Machine learning techniques for processing large amounts of data are broadly applicable in computational finance. The series of examples introduced in this topic provides a general workflow, illustrating how capabilities in MATLAB® apply to a specific problem in financial engineering. The workflow is problem-oriented, exploratory, and guided by the data and the resulting analysis. The overall approach, however, is useful for constructing applications in many areas.

The workflow consists of these actions:

Formulate a simple approach to algorithmic trading, through an analysis of market microstructure, with the goal of identifying real-time arbitrage opportunities.

Use a large sample of exchange data to track order dynamics of a single security on a single day, selectively processing the data to develop relevant statistical measures.

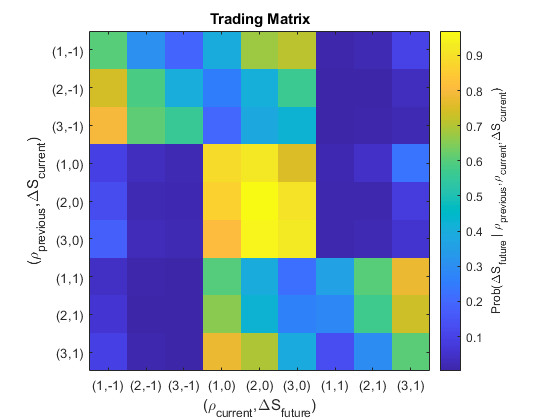

Create a model of intraday dynamics conditioned on a selection of hyperparameters introduced during feature engineering and development.

Evaluate hyperparameter tunings using a supervising objective that computes cash returned on a model-based trading strategy.

Optimize the trading strategy using different machine learning algorithms.

Suggest modifications for further development.

The workflow is separated into three examples:

For more information about general workflows for machine learning, see: