Loss Given Default Models

Calculate the loss given default (LGD) using a Regression, Tobit, or Beta model. Calculate the estimated loss reserves using Expected Credit Loss (ECL) calculator.

Functions

Objects

Regression | Create Regression model object for loss given

default (Since R2021a) |

Tobit | Create Tobit model object for loss given default (Since R2021a) |

Beta | Create Beta model object for loss given default (Since R2022b) |

Topics

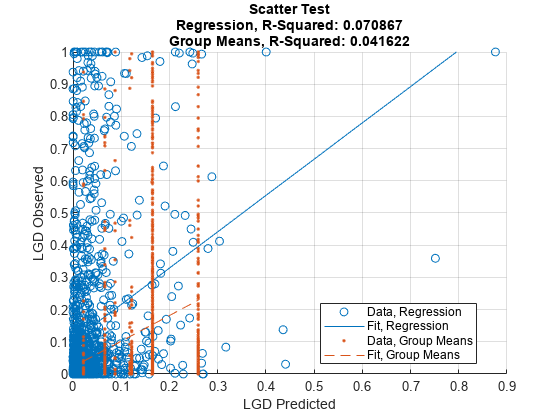

- Basic Loss Given Default Model Validation

This example shows how to perform basic model validation on a loss given default (LGD) model by viewing the fitted model, estimated coefficients, and p-values.

- Compare Tobit LGD Model to Benchmark Model

This example shows how to compare a

Tobitmodel for loss given default (LGD) against a benchmark model. - Compare Loss Given Default Models Using Cross-Validation

This example shows how to compare loss given default (LGD) models using cross-validation.

- Expected Credit Loss Computation

This example shows how to perform expected credit loss (ECL) computations with

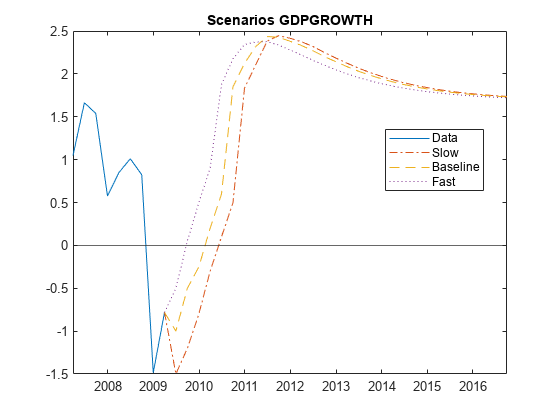

portfolioECLusing simulated loan data, macro scenario data, and an existing lifetime probability of default (PD) model. - Incorporate Macroeconomic Scenario Projections in Loan Portfolio ECL Calculations

This example shows how to generate macroeconomic scenarios and perform expected credit loss (ECL) calculations for a portfolio of loans.

- Modeling Probabilities of Default with Cox Proportional Hazards

This example shows how to work with consumer (retail) credit panel data to visualize observed probabilities of default (PDs) at different levels.

- Overview of Loss Given Default Models

Loss given default (LGD) is the proportion of a credit that is lost in the event of default.