Price Multiple CDS Option Instruments Using CDS Black Model and CDS Black Pricer

This example shows the workflow to price multiple CDSOption instruments using a CDSBlack model and a CDSBlack pricer.

Create ratecurve Object

Create a ratecurve object using ratecurve.

Settle = datetime(2021,9,20);

ZeroTimes = [calmonths(6) calyears([1 2 3 4 5 7 10 20 30])];

ZeroRates = [0.0052 0.0055 0.0061 0.0073 0.0094 0.0119 0.0168 0.0222 0.0293 0.0307]';

ZeroDates = Settle + ZeroTimes;

ZeroCurve = ratecurve("zero", Settle, ZeroDates ,ZeroRates)ZeroCurve =

ratecurve with properties:

Type: "zero"

Compounding: -1

Basis: 0

Dates: [10x1 datetime]

Rates: [10x1 double]

Settle: 20-Sep-2021

InterpMethod: "linear"

ShortExtrapMethod: "next"

LongExtrapMethod: "previous"

Create defprobcurve Object

Create a defprobcurve object using defprobcurve.

DefProbTimes = [calmonths(6) calyears([1 2 3 4 5 7 10 20 30])]; DefaultProbabilities = [0.005 0.007 0.01 0.015 0.026 0.04 0.077 0.093 0.15 0.20]'; ProbDates = Settle + DefProbTimes; DefaultProbCurve = defprobcurve(Settle, ProbDates, DefaultProbabilities)

DefaultProbCurve =

defprobcurve with properties:

Settle: 20-Sep-2021

Basis: 2

Dates: [10x1 datetime]

DefaultProbabilities: [10x1 double]

Create CDS Instrument Object

Use fininstrument to create an underlying CDS instrument object.

ContractSpreadBP = 0; % Contractual spread is determined on ExerciseDate CDS = fininstrument("CDS",'Maturity',datetime(2027,9,20),'ContractSpread',ContractSpreadBP)

CDS =

CDS with properties:

ContractSpread: 0

Maturity: 20-Sep-2027

Period: 4

Basis: 2

RecoveryRate: 0.4000

BusinessDayConvention: "actual"

Holidays: NaT

PayAccruedPremium: 1

Notional: 10000000

Name: ""

Create CDSOption Instrument Objects

Use fininstrument to create multiple CDSOption instrument objects.

ExerciseDate = datetime(2021, 12, 20); Strikes = [30:2:90]'; PayerCDSOptions = fininstrument("CDSOption",'Strike',Strikes,'ExerciseDate',ExerciseDate,'OptionType',"call",'CDS',CDS)

PayerCDSOptions=31×1 object

16x1 CDSOption array with properties:

OptionType

Strike

Knockout

AdjustedForwardSpread

ExerciseDate

CDS

Name

⋮

ReceiverCDSOptions = fininstrument("CDSOption",'Strike',Strikes,'ExerciseDate',ExerciseDate,'OptionType',"put",'CDS',CDS)

ReceiverCDSOptions=31×1 object

16x1 CDSOption array with properties:

OptionType

Strike

Knockout

AdjustedForwardSpread

ExerciseDate

CDS

Name

⋮

Price CDSOption Instruments

Assuming a flat volatility structure across strikes, first use finmodel to create a CDSBlack model object. Then use finpricer to create a CDSBlack pricer object. Use price to compute the prices for the CDSOption instruments.

SpreadVolatility = 0.3; CDSOptionModel = finmodel("CDSBlack",'SpreadVolatility',SpreadVolatility)

CDSOptionModel =

CDSBlack with properties:

SpreadVolatility: 0.3000

CDSOptionpricer = finpricer("analytic",'Model',CDSOptionModel,'DiscountCurve',ZeroCurve,'DefaultProbabilityCurve',DefaultProbCurve)

CDSOptionpricer =

CDSBlack with properties:

Model: [1x1 finmodel.CDSBlack]

DiscountCurve: [1x1 ratecurve]

DefaultProbabilityCurve: [1x1 defprobcurve]

PayerPrices = price(CDSOptionpricer,PayerCDSOptions)

PayerPrices = 31×1

171.7269

160.6802

149.6346

138.5931

127.5648

116.5716

105.6576

94.8983

84.4061

74.3266

⋮

ReceiverPrices = price(CDSOptionpricer,ReceiverCDSOptions)

ReceiverPrices = 31×1

0.0000

0.0003

0.0016

0.0070

0.0256

0.0794

0.2123

0.4999

1.0547

2.0221

⋮

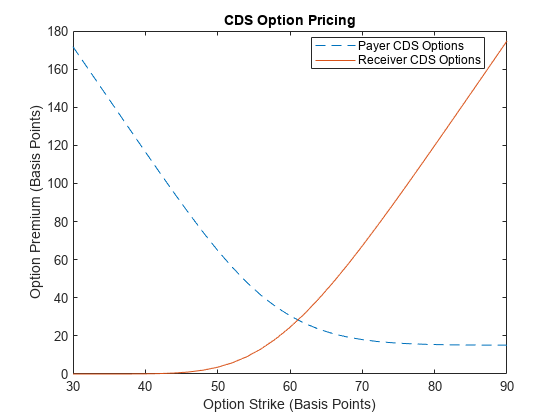

Plot CDS Option Prices

Plot the payer and receiver CDS option prices.

figure; plot(Strikes, PayerPrices, '--', Strikes, ReceiverPrices) title('CDS Option Pricing') xlabel('Option Strike (Basis Points)') ylabel('Option Premium (Basis Points)') legend('Payer CDS Options','Receiver CDS Options','Location','best')