Simulate systemic risk with MATLAB

Systemic risk is the risk of collapse of a macro-economic system or an aggregated financial system. It contrasts with individual risks that can be contained within, without harming an entire system.

Systemic risk arises when the failure of a single entity or cluster of entities generates “contagion,” cascading and perpetuating risk throughout financial and economic systems. For example, the 2007 collapse of financial giant Lehman Brothers had a ripple effect throughout the financial services community because of the company’s size and how integrated it was into the health of the economy.

Preventing systemic risk involves diverse applications and models, such as macro-economic theory, scenario generation (22:43), default estimation, macro-stress testing, and pricing theory. These are critical activities for central banks, non-governmental organizations (NGOs), regulators, government ministries, and policy-makers, as well as academic and financial services practitioners.

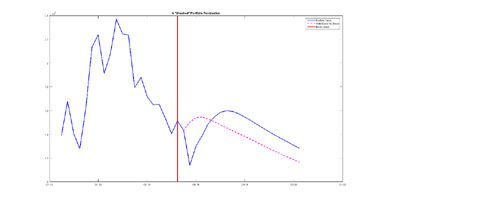

How a simulated systemic inflationary shock could impact financial performance and risk.

MATLAB®, in combination with Statistics and Machine Learning Toolbox™, Econometrics Toolbox™, Optimization Toolbox™, Global Optimization Toolbox, Risk Management Toolbox™, and other tools, is the software of choice among these practitioners. MATLAB enables systemic risk modeling, including statistical modeling, Monte Carlo simulation, graph theory, network and agent-based modeling, and pricing functions.

Examples and How To

- Use of MATLAB for Solvency II Capital Modelling: The Prudential Risk Scenario Generator (22:43) - Video

- IMF: Modeling General-Equilibrium Macro Stress Scenarios in MATLAB - Slides

- Quantitative Easing Near and Far: Finding Stability in Times of Crisis - Slides

- Forecasting Corporate Default Rates - Example

- Estimating Option-Implied Probability Distributions - Article

- Using Extreme Value Theory and Copulas to Evaluate Market Risk - Example

- Exploring Risk Contagion Using Graph Theory and Markov Chains - Technical Article

Software Reference

- copulacdf: Cumulative distribution for Gaussian copulas - Function

- prob.tLocationScaleDistribution: t location scale probability distribution - Documentation

- fmincon: optimization, for example, complementing a multivariate GARCH implementation - Function

- graph: Create undirected graph - Function

- digraph: Create undirected graph - Function

- creditDefaultCopula: Simulate and analyze multifactor credit default model - Documentation

See also: econometrics and economics, GARCH models, credit risk, liquidity risk, DSGE, portfolio optimization and analysis, concentration risk, risk management, fraud analytics