Portfolio analysis with MATLAB using the Black-Litterman model

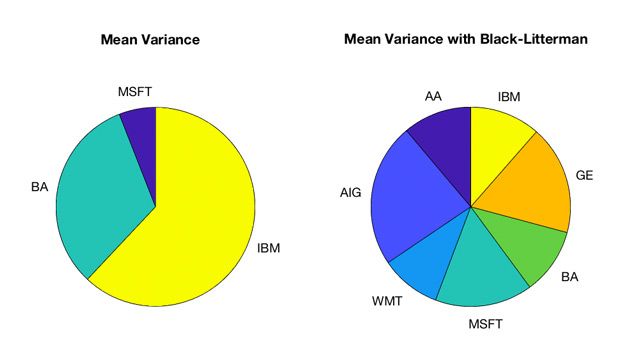

Black-Litterman is an asset allocation model that allows portfolio managers to incorporate views into CAPM equilibrium returns and to create more diversified portfolios than those generated by traditional mean-variance optimization.

Developed by Fisher Black and Bob Litterman in the 1990s, the Black-Litterman model uses mixed estimation techniques to combine the market equilibrium vector of expected returns with an investor-specific, usually Bayesian-derived, vector to form a new, posterior estimate of expected returns. The final vector of expected returns is assumed to have a probability distribution of the product of two multivariate normal distributions.

To overcome the limitations in modern portfolio theory, many asset management companies have adopted the Black-Litterman model to implement practical asset allocation models.

Distinguished financial engineers Attilio Meucci, Jay Walters and Sri Krishnamurthy offer downloadable implementations of the Black-Litterman method for use with MATLAB® and Financial Toolbox™.

Examples and How To

Software Reference

See also: portfolio optimization, CAPM, financial risk management, investment management, portfolio optimization and analysis, Global Optimization Toolbox