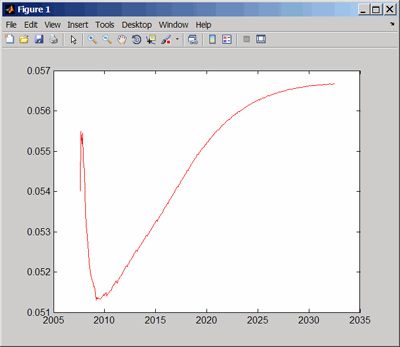

Build, plot, and analyze the yield curve

A yield curve is a graph that plots interest rates or yields of similar fixed-income instruments with differing maturities across time. The curve creates a visual representation of the term structure of interest rates. By aggregating lender priorities over time for a particular borrower or credit risk profile, yield curves enable you to study financial market conditions and analyze potential investments or trading opportunities.

Plotting a yield curve in MATLAB.

Yield curves are borrower-specific, so different curves are constructed for sovereign debt (e.g., the US Treasury default-free curve), the interbank markets (the swap curve), and corporate debt (a credit spread over the swap curve).

They are typically constructed and calibrated to the market prices of a variety of fixed-income instruments, including government debt, money market rates, short-term interest rate futures, and interest rate swaps. To build a smooth and consistent curve, you use a combination of bootstrapping, curve fitting, and interpolation techniques. These curves, once constructed, can then be used to price other OTC derivatives consistently with the markets.

For more information, see MATLAB® toolboxes for finance, data feeds, financial instruments, statistics, and curve fitting.

Examples and How To

- Forecasting with the Diebold-Li Model - Example

- Fitting Interest Rate Curve Functions - Example

- UniCredit Bank Austria Develops an Enterprise-Wide Market Data Engine - User Story

- Prepayment Modeling with a Two-Factor Hull-White Model - Example

- Sensitivity of Bond Prices to Parallel Shifts - Example

- Term Structure Analysis and Interest Rate Swap Pricing - Example

- Analysis of Inflation Indexed Instruments - Example

Software Reference

- Fitting and Analysis - Product Description

- Term Structure of Interest Rates - Documentation

- Analyze Curves - Function Reference

- Computing Treasury Bill Price and Yield - Function Reference

- Creating Interest-Rate Curve Objects - Function Reference

- Interest Rate Curve Objects - Documentation

See also: financial engineering, fixed income, financial derivatives, swap curve, zero curve, Econometrics Toolbox, Parallel Computing Toolbox, Symbolic Math Toolbox, Curve Fitting Toolbox, Spreadsheet Link (for Microsoft Excel)

Risk Management with MATLAB

Develop, manage, review, and challenge internal and regulatory models.