Analyze, calibrate, and price financial derivatives using the binomial model

The Cox-Ross-Rubinstein binomial model is a discrete-time numerical method you use to price contingent claim financial derivatives such as European options, American options, and exotic options with nonstandard structures.

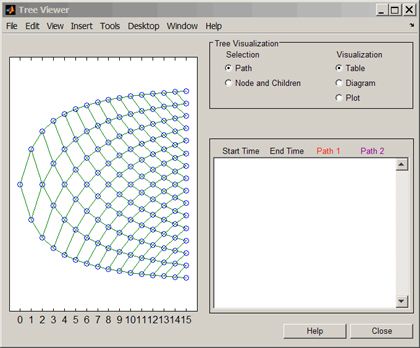

Visualization of a binomial tree

Binomial model option pricing generates a pricing tree in which every node represents the price of the underlying financial instrument at a given point in time. You can use this pricing tree to price options with nonstandard features such as path dependence, lookback, and barrier events. For more complex structures, it is better to use Monte Carlo simulation-based option pricing, because it is less computationally intensive.

You can use binomial models to:

- Build custom pricing models based on a choice of Cox-Ross-Rubinstein trees, Equal Probabilities trees, Leisen-Reimer trees, or Implied Trinomial trees

- Price vanilla and exotic options, compute sensitivities, and calibrate with market prices

- Analyze market prices of options to identify trading opportunities

- Design hedging strategies based on option greeks to measure and control market risk exposure

For more information, see MATLAB® toolboxes for finance and financial instruments.

Examples and How To

Software Reference

- Pricing Stock Options Using the Binomial Model - Documentation

- Construct Equal Probability Trees to Price Equity Derivatives - Function

- Fixed-Income Analysis and Option Pricing - Product Description

- Pricing and Analyzing Equity Derivatives - Documentation

- Equity Tree Models - Function Reference

- Monte Carlo Simulation for Equity Derivatives - Function Reference

See also: Fixed Income, Financial Derivatives, Econometrics Toolbox, Global Optimization Toolbox, Symbolic Math Toolbox, Pricing and valuation

Risk Management with MATLAB

Develop, manage, review, and challenge internal and regulatory models.