ICICI Securities Develops Online Financial Planning and Advisory Platform

Challenge

Solution

Results

- Three-hour, manual computational process drastically reduced

- Accuracy of financial plans improved

- Scalable financial planning platform launched

“Financial analysts and investment advisors typically do not have the programming skills to code effectively. Yet if they do not code themselves, it is difficult to experiment, develop, and back-test new methodologies. Even though our team of investment advisors had limited programming experience, MATLAB enabled us to develop and deploy a full-featured financial advisory platform.”

ICICI Securities Limited is the largest retail brokerage and investment firm in India. The company launched their Robo Advisory Platform Track&Act™ using MATLAB® as its advisory engine. A major enhancement to the company’s existing financial planning and advisory practice, Track&Act™ matches assets to liabilities and dynamically monitors each customer’s target asset allocation, savings rate, and portfolio progress. The platform’s advisory engine automates previously manual processes, enabling the company to offer personalized financial planning to its customer base, which comprises more than 3.6 million investors.

“The robustness and scalability of the platform that we developed lay the foundation for rapidly growing our advisory and financial planning practice—something that would just not be possible if we were using spreadsheets or similar tools,” says Abhishake Mathur, Senior Vice President for Investment Advisory Services and Customer Service at ICICI Securities.

Challenge

ICICI Securities financial advisors help clients articulate their investment goals, such as retirement, their children’s education, or purchase of a home or business. The financial advisors also collect information regarding current investments, savings, expected income, and expenditures.

In the past, advisors applied an hours-long manual process, using spreadsheet software to develop an investment plan based on the customer’s financial profile and psychometric factors such as risk preferences. ICICI Securities wanted to enhance their processes and adopt a new methodology by using more advanced computational techniques like Monte Carlo simulations and optimization. In addition, they wanted to build an investment platform to automate financial planning, asset-liability matching, and portfolio evaluation tasks.

The company’s advisors had the financial background and technical knowledge, and were looking for a robust framework to develop a complete solution. The team wanted to develop the platform in-house so that they would be able to make rapid changes.

Solution

ICICI Securities used MATLAB, Financial Toolbox™, and Optimization Toolbox™ to develop its automated investment advisory platform in-house.

Working in MATLAB, the Investment Advisory team, headed by Mathur, created various scripts to help them develop capital market expectations (CME) and an asset-liability matching algorithm.

MATLAB scripts were used to clean time-series data from short-term debt, long-term debt, gold, and equity markets.

Using MATLAB and Financial Toolbox they developed algorithms to determine long-term correlations in the assets and identify a set of efficient portfolios with optimal asset locations based on a customer’s profile information.

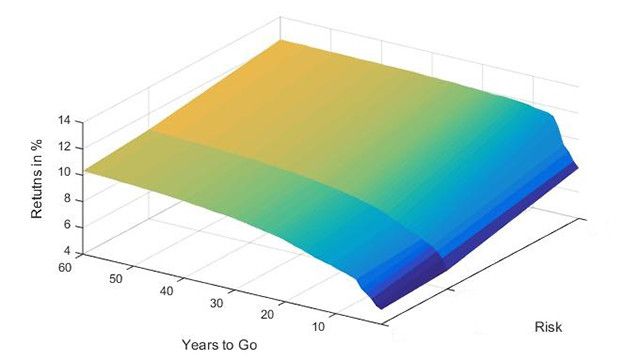

They then developed a MATLAB script to create asset allocation strategies by goal-risk profile and time horizon based on Monte Carlo simulation. The team went on to create an asset-liability matching algorithm using Optimization Toolbox. This algorithm enables them to develop customized investment strategies based on a client’s specific situation.

To enable the advisors to use these algorithms independently, standalone executable applications were created using MATLAB Compiler™. This approach has helped the team to institutionalize the use of new methodology to create financial plans.

The generated plan is delivered as a report to the customer and made available on the Track&Act™ platform on ICICIdirect.com, where it is automatically updated to reflect portfolio performance, current cash flow, and progress toward the customer’s goals.

Results

Three-hour, manual computational process drastically reduced. “In the past, advisors needed three hours or more to manually perform asset allocation based on a risk profile,” says Mathur. “The automated system we developed in MATLAB produces a more reliable, goal-based asset allocation almost immediately.”

Accuracy of financial plans improved. “By using MATLAB, we have been able to significantly improve the accuracy of suggested asset allocation strategies within financial plans based on clients’ goals, as well as the suggested allocation for their surplus funds,” notes Mathur. “We can run millions of simulations to deliver advice that is specific to a client’s situation.”

Scalable financial planning platform launched. “MATLAB enabled ICICI Securities to develop algorithms for defining optimal investment portfolios based on matching a customer’s current assets and future cash flows,” says Mathur. “Just as important, it enabled us to deploy those algorithms as a robust and scalable platform with MATLAB Compiler.”